This Week

Once again, markets were focused on the Federal Reserve and artificial intelligence (AI) investment this week.

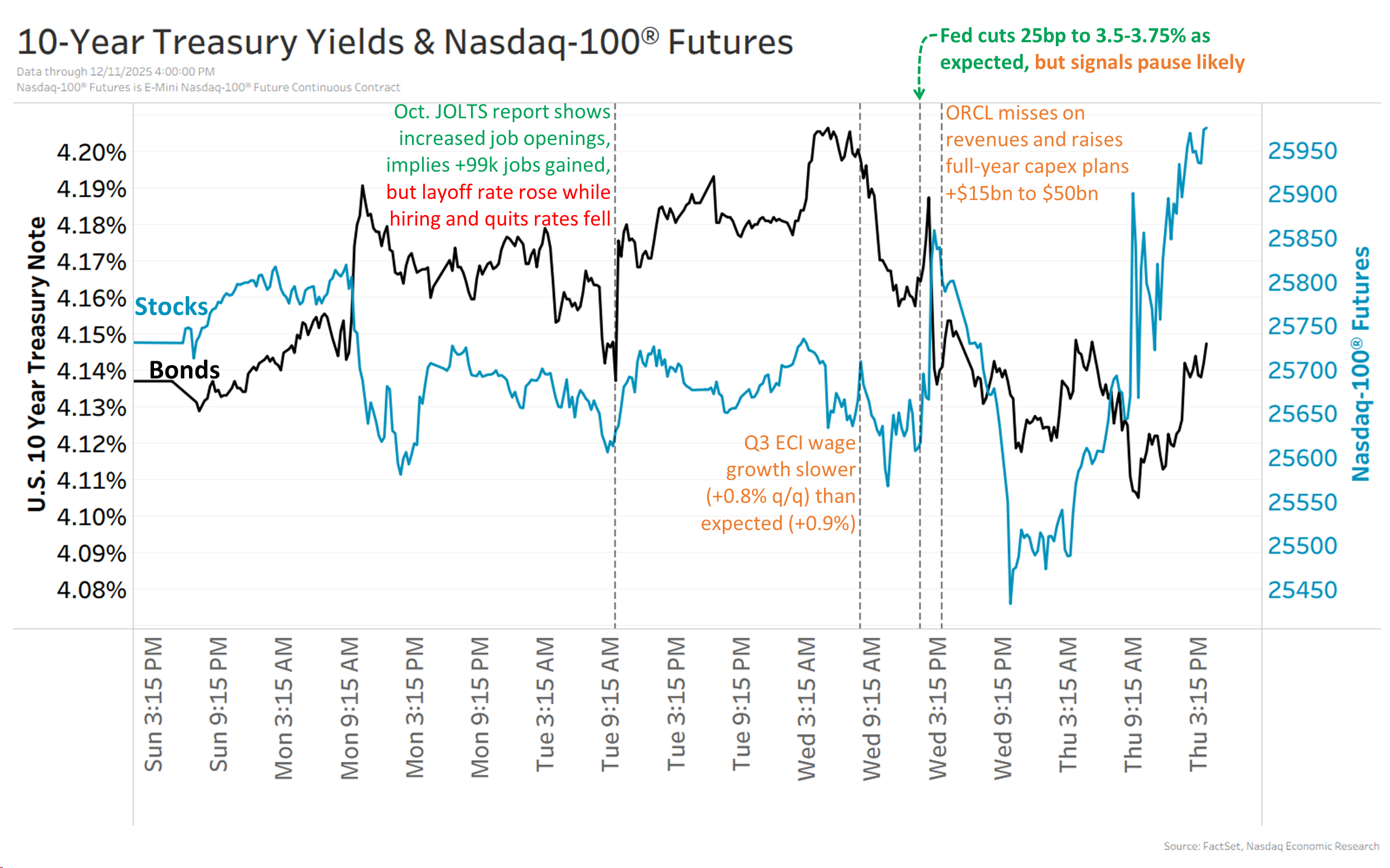

For the Fed, they remain more concerned about the weak labor market than above-target inflation. Given this, they cut 25 basis points for the third straight meeting, bringing the fed funds rate down to a 3-year low of 3.75%. From here, though, they signaled a pause is likely since they expect the economy to improve in 2026. Specifically, they forecast faster real GDP growth (2.3% vs. 1.7% in 2025), slowing core inflation (2.5% vs. 3.0%), and slightly lower unemployment (4.4% vs. 4.5%), and just one rate cut (markets see two).

Shortly after the Fed meeting, Oracle’s earnings renewed AI spending concerns. Oracle missed on revenues and operating income, while boosting its full-year capex plans over 40% to $50 billion, raising worries about when AI investment will translate to profits.

For the week, the Nasdaq-100® (blue line) and 10-year Treasury yields (black line) were both roughly flat.

Next Week

Here are the top events I’m watching next week:

- November nonfarm jobs on Tuesday

- November CPI inflation on Thursday

- October retail sales on Tuesday

#Weekly #Chartstopper #December