Key Points

-

Iren scored a $9.7 billion deal to provide data center computing capacity to Microsoft.

-

Iren’s core business could erode if the price of Bitcoin collapses again.

-

Equinix is a leading data center REIT with AI tailwinds that will drive long-term growth.

- 10 stocks we like better than Iren ›

Iren (NASDAQ: IREN) has been a massive winner over the past three years. The explosive revenue growth of 750% for the company has driven the stock price up by 3,360% during that period. The company owns and operates data centers, selling computing capacity to its customers. After focusing for years on Bitcoin (CRYPTO: BTC) mining, Iren is now pivoting to using its hardware to power artificial intelligence (AI) data centers.

Its new five-year, $9.7 billion contract with Microsoft is a game changer. Iren plans to expand its hardware backbone to 140,000 GPUs over the next year, which could take the company’s annualized revenue run rate to $3.4 billion. That would be another explosive leap for a business that had $685 million in total revenue over the past four quarters.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Sounds great, right? Now, forget that stock. Here’s why investors would be better served to buy Equinix (NASDAQ: EQIX) instead and hold onto it for the long term.

Iren’s growth could fade as quickly as it arrived

The Microsoft deal suggests that Iren is poised to become the next major player in the data center space. However, there are some serious red flags to consider.

Image source: Getty Images

Iren built its business on Bitcoin mining. That represented 97% of the company’s revenue in its most recent quarter. Iren is using its cash flow, along with prepayments from Microsoft and other sources, to fund its massive GPU purchases.

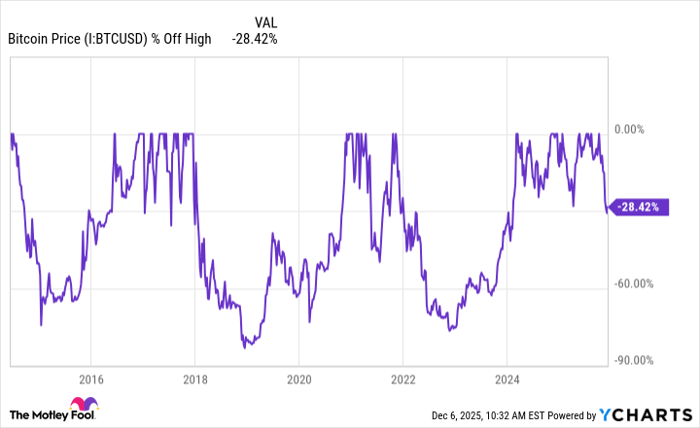

But Bitcoin mining requires healthy price action to be profitable, and the original crypto’s price has historically been volatile: It has declined by more than 60% on several occasions throughout its existence. Moreover, it has fallen by nearly 30% from its all-time high since the start of October.

Bitcoin Price data by YCharts.

If the crypto suffers a prolonged downturn, money flowing into Bitcoin mining could slow or cease as mining becomes less profitable. The risk of Iren’s core business drying up threatens both its AI expansion plans and its stock price. Given those risks, it may be wise to consider a more reliable investment, even if it offers less upside.

This leading data center landlord is doubling its capacity

Equinix is a real estate investment trust (REIT) and a leading data center builder and operator. Its buildings are designed with the latest in data center features, and it rents them to tenants that often bring their own computing hardware. That means Equinix doesn’t need to invest in pricey cutting-edge GPUs. Its rental income translates into stable cash profits that Equinix distributes to investors as nonqualified dividends.

It currently operates 273 data centers worldwide, and plans to double its capacity by 2029. Annualized gross bookings rose by 25% year over year in its most recent quarter, indicating that Equinix is clearly benefiting from AI demand. Its entrenched tenant base provides the stock with a much higher floor than Iren.

Investing ultimately boils down to personal preferences. Those who are uneasy with Iren’s vulnerability to Bitcoin’s volatility may want to consider Equinix as an alternative. The REIT also offers AI data center exposure, and its dependability makes it arguably the better long-term holding.

Should you invest $1,000 in Iren right now?

Before you buy stock in Iren, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Iren wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 8, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Equinix, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Forget #Irens #Explosive #Growth #Buy #LongTerm #Stock