Key Points

-

TMC The Metals Company is attempting to build a mining business.

-

The twist is that the mining operation is slated to take place underwater.

-

Investors should tread with caution, and recent stock price performance highlights why.

- 10 stocks we like better than TMC The Metals Company ›

There is nothing particularly special about a mining company. However, TMC The Metals Company (NASDAQ: TMC) isn’t your run-of-the-mill miner. At least, it is hoping that it will be a different breed of miner. That’s because the company isn’t yet operational.

There’s a lot to unpack here. And once you know the details, you’ll see that investors hoping to set themselves up for life by buying shares of TMC The Mining Company should tread with caution.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

What does TMC The Metals Company do?

Right now, TMC The Metals Company is largely an idea. The hope is that the company will eventually operate in underwater mining. To be fair, management isn’t simply pitching a good story. It has been working to develop the necessary technology to mine the sea floor and to obtain the necessary approvals to commence its operations. Still, the entire investment thesis around TMC The Metals Company is largely built on a story.

From a financial standpoint, the company is a money-losing start-up. The company’s income statement doesn’t contain any revenue, starting instead with operating expenses. The operating loss for the third quarter of 2025 was $55 million, with a net loss of $184 million. On a per-share basis, the net loss amounted to $0.46.

Only the most aggressive growth investors should consider a company like TMC The Metals Company. While the potential opportunity of mining the oceans may sound great, the risk of investing in a business that has yet to actually mine the oceans is very high. If the company fails to obtain the necessary approvals, falls short of the required funding to launch its business, or encounters difficulties executing its plans, the business may struggle to survive.

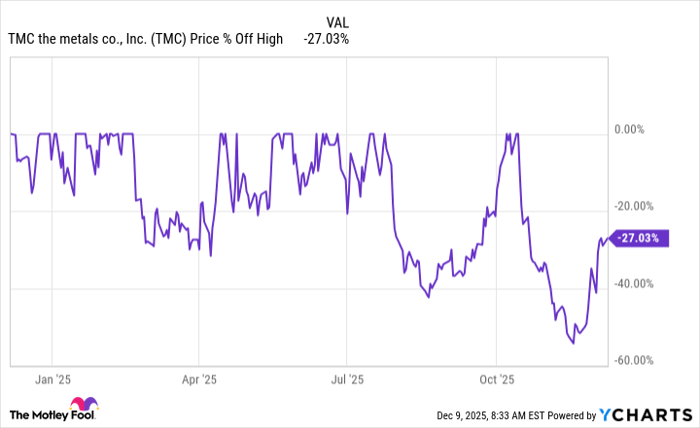

Data by YCharts.

The risk is on clear display

Many investors will look at the stock of TMC The Metals Company and see only that it has risen by more than 800% in a year. That level of stock appreciation is phenomenal, and some investors might feel like they are missing out on an opportunity. But is it worth following the crowd with what is still just a money-losing start-up? The answer for most will be no.

You don’t need to look very far for the reason, either. Over the past year, the stock has risen 800%. However, over the 52-week period, the share price fell by 25% and 40%, recovering and then going on to new highs each time. It is currently in the middle of a 50% drawdown, from which it has yet to fully recover. It remains about 25% from its 52-week high. That is a huge amount of volatility in a very short period of time.

Remember, however, that there isn’t a material business backing the stock. The stock price is largely driven by investor emotions and news. It is virtually impossible to predict either one, so there’s no way to really know what to expect from the stock, let alone the business backing it. Buying TMC The Metals Company in the hope that it will set you up for life is little more than a leap of faith right now.

There’s nothing wrong with TMC The Metals Company

What TMC The Metals Company is attempting to do is very interesting. If it works out as well as management hopes, the company could be very valuable. The problem is that there’s no way to know whether the company can bring its business plan to fruition. That’s a huge risk to take on with the stock’s volatility over the past year, highlighting what can happen when investors lose faith in the company’s future.

Should you invest $1,000 in TMC The Metals Company right now?

Before you buy stock in TMC The Metals Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TMC The Metals Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 8, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Buying #TMC #Metals #Company #Stock #Today #Set #Life