In our preview of NVDA’s Q3 results, we said that it’s not a question whether the company beats – they always do – but whether the “blowout” and the “smash” will be big enough to impress a market that has already priced in perfection, and beyond, for the GPU maker.

The market was impressed.

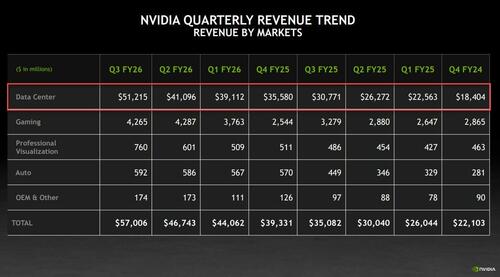

Here is what NVDA just reported for Q3:

- Adjusted EPS $1.30, beating estimates of $1.24

- Revenue $57.01 billion, up +62% y/y, beating estimate $55.19 billion, and up $3BN vs guidance

- Data center revenue $51.2 billion, +66% y/y, beating estimate $49.34 billion

- Gaming revenue $4.3 billion, +30% y/y, missing estimate $4.42 billion

- Professional Visualization revenue $760 million, +56% y/y, beating estimate $612.8 million

- Automotive revenue $592 million, +32% y/y, missing estimate $620.9 million

- Adjusted operating income $37.75 billion, +62% y/y, estimate $36.46 billion

- Adjusted operating expenses $4.22 billion, +38% y/y, estimate $4.22 billion

- Adjusted gross margin 73.6%, missing est 74.0% and down from 75.0% a year ago.

- R&D expenses $4.71 billion, +39% y/y, estimate $4.66 billion

- Free cash flow $22.09 billion, +32% y/y

And visually, the stunning fact here is that Data Center rose $10BN sequentially, and up 66% YoY.

While there were some blemishes across the various segments, most notably gaming and automotive, which missed, these are negligible for the company considering its Data Centers revenue was a whopping $51.2BN, up 66% YoY, and smashing estimates of $49.3BN by nearly $2BN.

And if historicals were impressive, the outlook was even more blowout:

- Revenue is expected to be $65.0 billion, plus or minus 2% (i.e. $63.70 billion to $66.30 billion) , smashing expectations of $61.98BN (although there were some buyside bogeys as high as $75BN which means that Huang is likely sandbagging again).

- Gross margins (GAAP and non-GAAP) are expected to be 74.8% and 75.0%, respectively, plus or minus 50 basis points.

- Operating expenses (GAAP and non-GAAP) are expected to be approximately $6.7 billion and $5.0 billion, respectively.

Commenting on the quarter, CEO Jensen Huang said that “Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Investors’ initial reaction to Nvidia’s results — including a big beat on its 4Q revenue guidance — is good. Shares spiked more than 4% in postmarket trading.

This is important, because the fate of Nvidia’s stock determines the the AI trade, and the broader market: Nvidia holds the largest weighting in the S&P 500 Index – hangs heavily on how investors digest the results and commentary from the company.

Yet while Nvidia shares are sharply higher, the move reverses only part of a slump that saw the stock slip about 10% below a record high set at the end of October.

In any case, Nvidia’s results are strong enough to also lift shares of other stocks tied to artificial intelligence in after-hours trading: shares of CoreWeave and Nebius are up 4%, AMD is up nearly 2%, Micron is up about 2% and Broadcom shares are moving higher as well.

In short: Nvidia just saved the possibility of a Christmas rally.

Loading recommendations…

#GPUs #Sold #Nvidia #Soars #Blowing #Results #Projections