Key Points

-

U.S. growth has been trending up since Trump’s inauguration one year ago.

-

Although the economy may appear strong, the stock market could be on a nasty collision course with history.

-

Assessing the overall economic picture is tough right now, and investors should be cautious how they allocate capital.

- 10 stocks we like better than S&P 500 Index ›

During his first term in office, President Donald Trump enjoyed touting how well the stock market was performing. Since Trump assumed office for a second term about one year ago, the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC) have risen 15% and 19%, respectively.

The biggest catalyst fueling the bull market is rising investments in artificial intelligence (AI) and infrastructure. As the stock market soars to new highs, the U.S. economy is also posting some pretty impressive growth of its own.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let’s analyze the overall macroeconomic picture and dig into some of the more subtle forces fueling the S&P 500 right now. While the president continues to pump up his economic agenda, smart investors shouldn’t fall for the optimistic narrative so quickly.

Image source: Daniel Torok (official White House photo)

President Trump’s economy is booming, but…

Gross domestic product (GDP) measures the total value of goods and services produced over a given period. Like all economic indicators, GDP presents a limited picture and should not be looked at in isolation.

But broadly speaking, rising GDP implies that companies are selling more product and wages are rising — providing the government with a larger tax base. GDP is critical in determining fiscal and monetary policy as well as corporate budgeting.

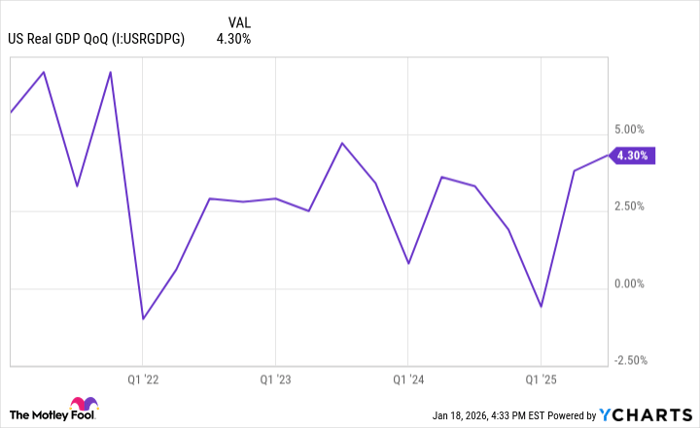

US Real GDP QoQ data by YCharts

While real GDP dipped in the first quarter, growth was strong for most of 2025. In the third quarter, the most recently reported, annualized growth of real GDP was 4.3%.

During a recent interview, Treasury Secretary Scott Bessent expressed his views on the economy — saying growth could “surprise on the upside” and calling for a nominal GDP rate of 7% to 8%. This commentary could be misunderstood if investors don’t catch one key word: “nominal.”

Nominal GDP measures total economic production solely through the lens of prices, whereas real GDP is adjusted for inflation. This distinction is important because the current U.S. economy is propped up by Trump’s new tariffs.

In essence, nominal GDP could make it seem as if the economy is growing simply because of higher prices, perhaps partly caused by the tariffs. But in reality, these prices could flow down to the consumer — diminishing purchasing power and hurting demand and production.

Although unknowns over economic health remain, it would appear that some in Washington are generally optimistic on where we’re headed overall. Does that mean investors are in the clear for 2026? Not so fast.

…Is the stock market telling us something deeper?

When investors look at the S&P 500, analyzing its overall value doesn’t reveal much. A lesser-known, but critically important, figure to look at is the cyclically adjusted price-to-earnings (CAPE) ratio. The CAPE ratio indicates corporate earnings growth relative to stock prices.

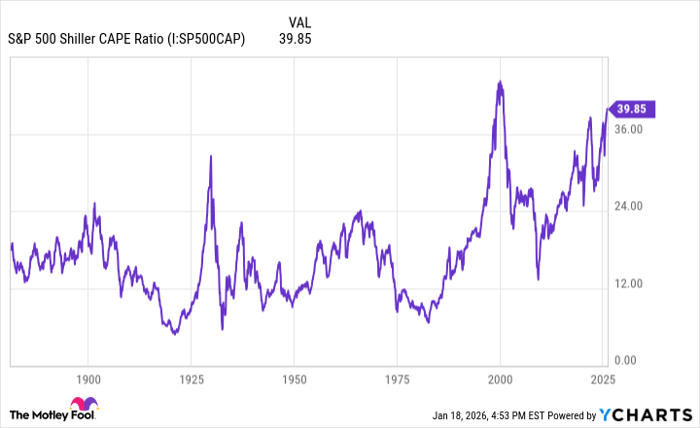

S&P 500 Shiller CAPE Ratio data by YCharts

During the past few years, the CAPE ratio has been rising sharply. Currently, it is hovering at about 40.

Per the illustration above, there are only two times in history that the CAPE ratio has trended between 30 and 40 — the 1920s and the year 2000. In both cases, the stock market witnessed harsh corrections: the crash that caused the Great Depression and the bursting of the dot-com bubble, respectively.

What is the smartest way to invest in 2026?

On one hand, the largest companies in the world — many of which operate in the technology sector — are all doubling down on infrastructure investment. They’re building new data centers, procuring more chips, and releasing next-generation products and services, all of which should contribute to further economic expansion.

At the same time, unemployment levels remain high, and it’s anyone’s guess whether the Federal Reserve will reduce or hike interest rates this year.

Here’s the big picture: The analysis above doesn’t necessarily mean a sell-off is imminent. Even more important, the lengths of stock market corrections vary. In other words, even if the S&P 500 drops in 2026, the sell-off could be short-lived.

In my eyes, the smartest way to invest this year is to reduce exposure to volatile growth stocks and speculative positions.

Instead, I would opt for a basket of blue chip stocks across different industries — building a diversified portfolio of well-established, durable businesses. In addition, padding your portfolio with some extra liquidity (cash and short-term treasuries) can help offset any volatility you may feel from the equity market and give you a reserve to buy the dip if such an opportunity arises.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $474,578!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,141,628!*

Now, it’s worth noting Stock Advisor’s total average return is 955% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 21, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#President #Donald #Trump #Oversees #Strong #GDP #Growth #Stock #Market #Flashing #Ominous #Signal #Heres #History #Suggests