Key Points

-

Investors have every reason to smile, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite rising by 15%, 18%, and 22%, respectively, in 2025.

-

Wall Street’s biggest bargains are found by looking to the future, not reliving the past.

-

Some of the most attractive stocks to buy for 2026 possess well-defined competitive advantages, pristine balance sheets, and are historically cheap.

- 10 stocks we like better than Sirius XM ›

With just a handful of trading days left in 2025, it would appear investors have ample reason to smile. Through the closing bell on Dec. 24, the mature stock-driven Dow Jones Industrial Average, benchmark S&P 500, and growth-dominated Nasdaq Composite have soared by 15%, 18%, and 22%, respectively.

But investing on Wall Street isn’t about looking in the rearview mirror at where we’ve been — it’s about planning for the future. As we ready to turn the page to 2026, here are seven unbeatable stocks I’m eager to buy in the new year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

1. Sirius XM Holdings

Only one company has made the list of unbeatable stocks that I’m itching to buy two years in a row, and it’s satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI). Although Sirius XM’s subscriber growth has stalled in recent quarters, a bevy of competitive advantages has the company primed for long-term success.

For instance, it’s one of America’s few publicly traded legal monopolies. Even though it still competes with traditional radio operators for listeners, being the only company with satellite-radio licenses affords it premier subscription pricing power.

But perhaps even more important than its legal monopoly status is its revenue mix. While most terrestrial and online radio providers are overwhelmingly reliant on advertising revenue to keep the lights on, Sirius XM generates approximately three-quarters of its net sales from subscriptions. The latter leads to fewer cash flow fluctuations during periods of economic turbulence.

Sirius XM’s dividend yield of more than 5%, coupled with its forward price-to-earnings (P/E) ratio of less than 7, makes it a standout bargain amid a historically pricey stock market.

2. The Trade Desk

Although I’m focusing more on value than growth at the moment, adtech titan The Trade Desk (NASDAQ: TTD) is checking all the right boxes to be both a value and growth stock. Despite tariff concerns impacting some of its core advertisers, The Trade Desk has clear catalysts in its sails.

To begin with, ongoing cord-cutting has put the company at the center of the digital ad revolution. In particular, video (and more specifically connected TV) likely accounts for around half of The Trade Desk’s revenue. Connected TV is a sustained double-digit growth opportunity as viewers continue to move away from legacy networks.

Furthermore, The Trade Desk’s Unified ID 2.0 (UID2) technology has gained widespread adoption as a replacement for third-party tracking cookies. In other words, UID2 should play a crucial role in helping advertisers target their messages effectively. The more relevant the messaging to the user, the more valuable its programmatic ad platform.

A forward P/E of 18 with sustained sales growth in the mid-to-high teens is a compelling combo.

Image source: Pinterest.

3. Pinterest

Another unbeatable growth and value stock that I’m eager to add to in 2026 is social media up-and-comer Pinterest (NYSE: PINS). Though Pinterest’s quarterly sales forecasts haven’t impressed Wall Street in back-to-back quarters, many of its key performance indicators (KPIs) suggest the company remains on the right track.

For instance, Pinterest reached 600 million global monthly active users (MAUs) in the September-ended quarter. Following a brief period during which global MAUs contracted after the worst of the COVID-19 pandemic, user growth is once again increasing by a double-digit percentage compared to the previous year.

What’s even more important is that average revenue per user (ARPU) is climbing worldwide. Although ARPU growth of 5% in the U.S. and Canada leaves room for improvement, Pinterest recorded ARPU increases of 31% and 44% for Europe and the “Rest of World,” respectively, during the September-ended quarter.

With sustained annual sales growth of 15% and $2.67 billion in cash, cash equivalents, and marketable securities on its balance sheet, with no debt, Pinterest’s forward P/E ratio of 13.5 doesn’t do it justice.

4. Goodyear Tire & Rubber

A fourth sensational stock I’m looking forward to buying more of in the new year is tire and related services company Goodyear Tire & Rubber (NASDAQ: GT).

Goodyear is in the midst of a multi-year transformation plan, known as Goodyear Forward, which has seen it divest three of its non-core assets in an effort to reduce its net leverage. Since unveiling this strategy two years ago, Goodyear has lowered its net debt by $669 million.

At the same time, management has focused its efforts on higher-margin tire and service opportunities. With drivers in the U.S. keeping their vehicles longer than ever before, non-original equipment manufacturer tire sales and service opportunities represent some of the long-term margin-expansion catalysts for Goodyear.

If rubber prices were to weaken in 2026 or 2027, it could also lead to margin expansion for Goodyear Tire, which is currently sporting a reasonably low forward P/E of 7.7.

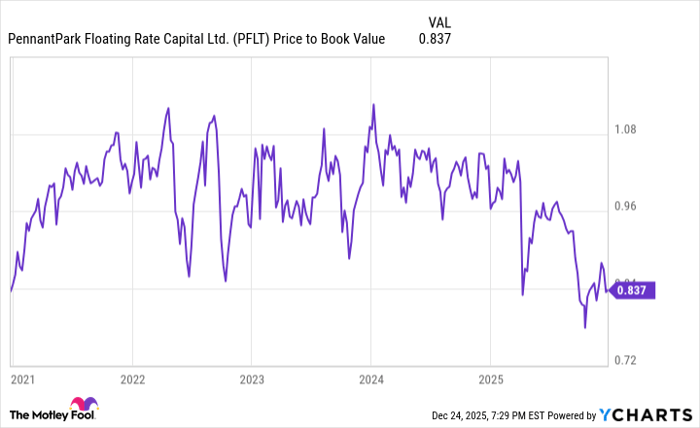

PennantPark Floating Rate Capital shares are trading at a significant discount to their book value. PFLT Price to Book Value data by YCharts.

5. Pennant Park Floating Rate Capital

Some of Wall Street’s most attractive investment opportunities are flying under the radar. Small-cap business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT) and its 13.6% annual dividend yield are a perfect example.

BDCs invest in the debt or equity (common and preferred stock) of generally unproven businesses. PennantPark has focused most of its $2.77 billion investment portfolio on loans. This debt-driven approach helped it generate a 10.2% weighted-average yield on its loan portfolio during the fiscal fourth quarter, ended Sept. 30, 2025.

Of equal importance are PennantPark’s efforts to protect its invested principal. Its entire portfolio, including common and preferred stock, is spread across 164 companies, which works out to an average investment size of $16.9 million. Further, only 0.4% of its portfolio, on a cost basis, was delinquent on payments as of the end of September. Top-notch vetting has ensured steady income and an above-average yield.

The cherry on the sundae with PennantPark Floating Rate Capital is that it’s trading at a 16% discount to its book value per share of $10.83, as of Sept. 30.

6. The Campbell’s Company

I’m a big fan of turnaround stories. For 2026, brand-name food and beverage colossus The Campbell’s Company (NASDAQ: CPB) has my full attention. While higher food inflation and tariff-related uncertainties are weighing on Campbell’s bottom line, these issues appear temporary and aren’t indicative of company-specific problems.

One factor working in Campbell’s favor is that it predominantly sells basic need goods. Although snacks are arguably a discretionary item, everyone needs food and beverages to survive. With economic expansions lasting substantially longer than recessions, it means that consumer buying habits and their preference for premium/brand-name food and beverage products won’t change much. This leads to consistency in Campbell’s operating cash flow.

Campbell’s story also involves tightening its belt and making strategic investments in its supply chain. Last year, the company identified $250 million in enterprise cost savings that it expects to fully recognize by fiscal 2028 (the company’s fiscal year ends in late July or early August). At the same time, it’s outlaying $230 million across several manufacturing projects to modernize its production lines and make them more efficient.

Though Campbell’s efforts won’t lead to a turnaround overnight, its forward P/E of 10.7 represents a historic low for the company.

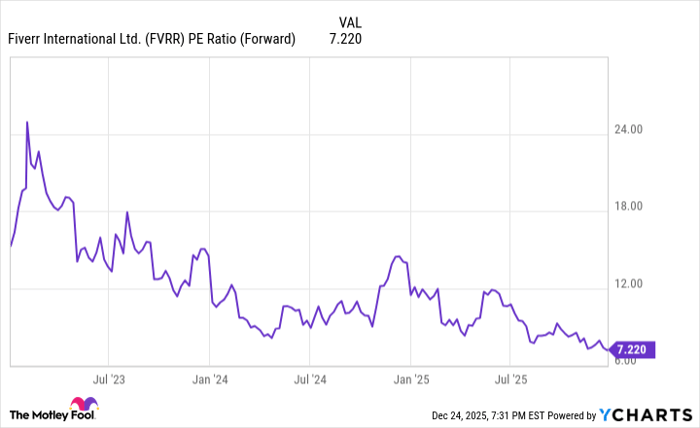

FVRR PE Ratio (Forward) data by YCharts. Forward P/E data based on 2025 estimated earnings per share.

7. Fiverr International

The seventh and final unbeatable stock I’m eager to buy in 2026 is none other than online-services marketplace Fiverr International (NYSE: FVRR). Although a decline in annual active buyers has left some investors skeptical, most of Fiverr’s KPIs portend steady growth to come.

Despite a nearly 12% decline in annual active buyers for the September-ended quarter, annual spend per buyer increased by 12%. Given that more jobs have gone remote on a part-time or full-time basis since the pandemic, Fiverr’s online marketplace, which matches businesses with freelancers, is ideally positioned to thrive. A double-digit percentage increase in spend per buyer is evidence of this in action.

What’s even more noteworthy is Fiverr’s industry-leading marketplace take rate of 27.6%. Compared to other online marketplaces for freelancers, Fiverr is successfully grabbing a larger percentage of each negotiated deal (including fees). This is a recipe for superior long-term margins.

Fiverr’s forward P/E of 6.7 is effectively an all-time low, making its shares an eye-popping bargain for the new year.

Should you buy stock in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of December 29, 2025.

Sean Williams has positions in Fiverr International, Goodyear Tire & Rubber, PennantPark Floating Rate Capital, Pinterest, and Sirius XM. The Motley Fool has positions in and recommends Fiverr International, Pinterest, and The Trade Desk. The Motley Fool recommends Campbell’s. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Unbeatable #Stocks #Eager #Buy